What is an IRS Response Letter?

An IRS response letter is a document that is sent to the IRS in response to a letter or notice that the IRS has sent to you. The letter should be clear, concise, and professional. It should also be formatted correctly and include all of the necessary information.

Why is it important to create a professional IRS response letter?

A professional IRS response letter can help you resolve your tax issue more quickly and efficiently. It can also help you avoid penalties and interest.

Design Elements that Convey Professionalism and Trust

The design of your IRS response letter is just as important as the content. A well-designed letter will make you appear more professional and credible.

Here are some design elements that you should consider when creating your IRS response letter:

1. Use a professional font

A professional font will make your letter look more polished and credible. Some good choices for fonts include Times New Roman, Arial, and Calibri.

2. Use a consistent font size and style

Using a consistent font size and style will make your letter easier to read. You should also use a font size that is large enough to be easily read by people with visual impairments.

3. Use white space effectively

White space is the space between lines of text and paragraphs. Using white space effectively will make your letter easier to read and understand.

4. Use a clear and concise layout

A clear and concise layout will help your reader quickly find the information they are looking for. You should use headings and subheadings to break up your letter into sections.

5. Use high-quality paper

Using high-quality paper will make your letter look more professional and credible. You should also use a laser printer to print your letter.

6. Proofread your letter carefully

Proofreading your letter carefully will help you avoid errors that could make you look unprofessional. You should also have someone else proofread your letter for you.

7. Sign your letter legibly

Signing your letter legibly will make you look more professional and credible. You should also use a blue pen to sign your letter.

Content of an IRS Response Letter

The content of your IRS response letter should be clear, concise, and professional. It should also include all of the necessary information.

Here are some of the things that you should include in your IRS response letter:

1. Your name and contact information

Your name and contact information should be included at the top of your letter.

2. The date

The date should be included at the top of your letter.

3. The IRS address

The IRS address should be included at the top of your letter.

4. The IRS reference number

The IRS reference number should be included at the top of your letter.

5. A clear and concise subject line

The subject line should be clear and concise. It should also include the IRS reference number.

6. A salutation

The salutation should be followed by the IRS agent’s name.

7. A clear and concise statement of your issue

You should clearly and concisely state your issue in the first paragraph of your letter.

8. Supporting documentation

You should attach any supporting documentation to your letter.

9. A request for action

You should conclude your letter by requesting the IRS to take the action that you want them to take.

10. A closing

The closing should be followed by your signature and printed name.

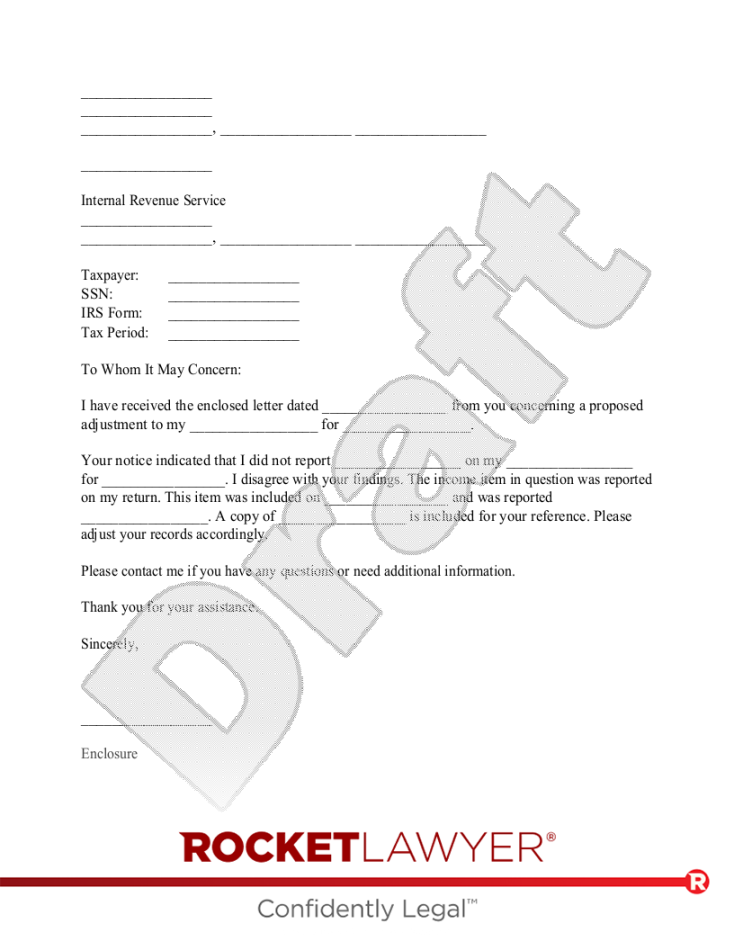

Sample IRS Response Letter

Here is a sample IRS response letter:

Dear IRS Agent Smith,

I am writing to you in response to your letter dated April 15, 2024, regarding my tax return for the year 2023.

I believe that there has been a mistake made in the calculation of my tax liability. I have attached a copy of my tax return and supporting documentation to this letter.

I respectfully request that you review my tax return and make the necessary corrections.

Thank you for your attention to this matter.

Sincerely,

John Doe

Conclusion

Creating a professional IRS response letter is important. A well-designed letter will make you appear more professional and credible. It can also help you resolve your tax issue more quickly and efficiently.

I hope this guide has been helpful. If you have any questions, please feel free to contact me.

Additional Resources

IRS website: [https://www.irs.gov/](https://www.irs.gov/)