Understanding the Importance of a Debt Validation Letter Template

A well-crafted debt validation letter template is crucial for individuals who are disputing the accuracy or legitimacy of a debt. It serves as a formal communication tool to request specific information about the debt, protecting your rights and initiating the debt validation process.

Key Design Elements for a Professional Template

To convey professionalism and trust, incorporate the following design elements into your debt validation letter template:

1. Header and Footer

Header: Include your full name, address, contact information, and the date.

2. Salutation

3. Body

Clear and Concise Language: Use simple, direct language that is easy to understand. Avoid jargon or technical terms.

4. Closing

5. Enclosures

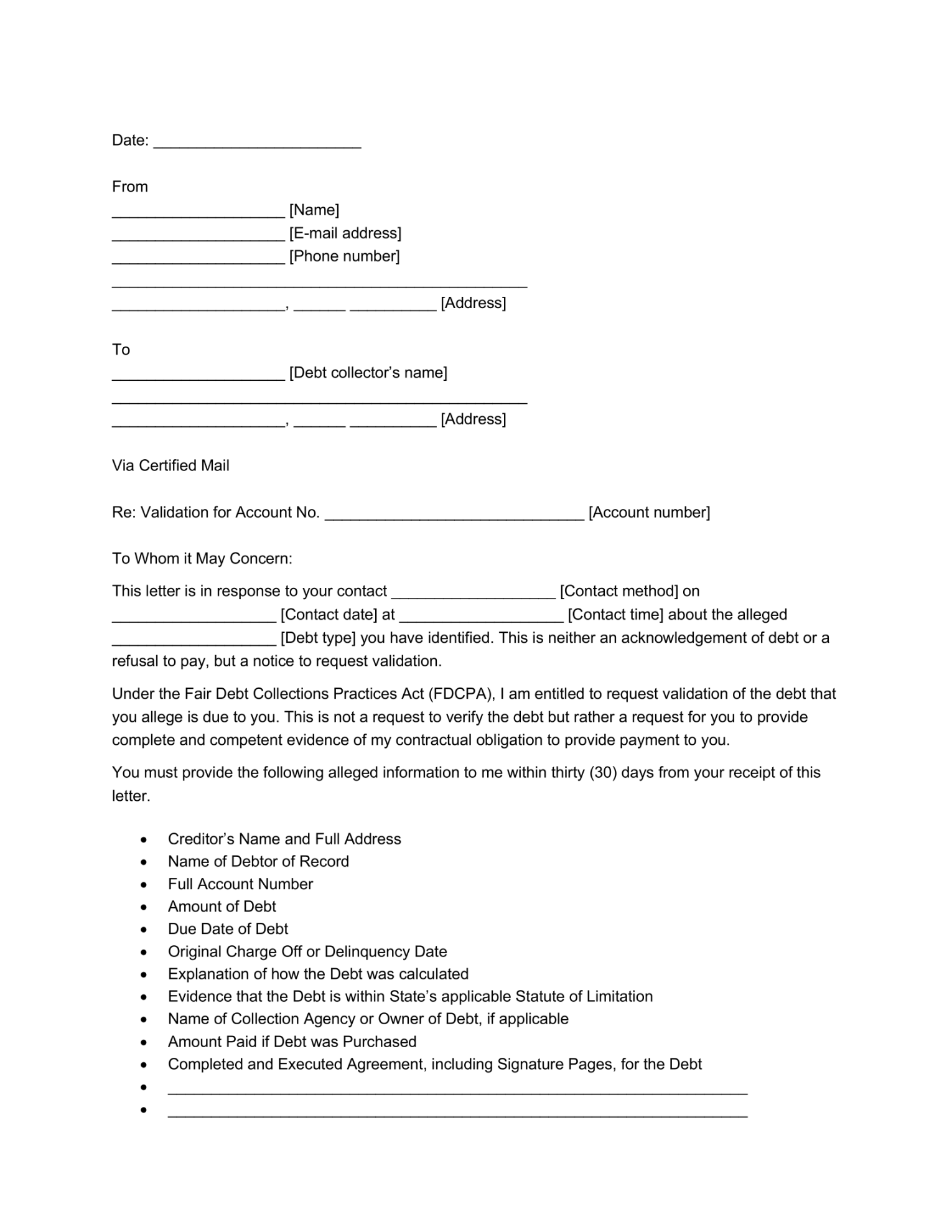

Sample Debt Validation Letter Template

[Your Name]

[Your Address]

[Your City, State, ZIP Code]

[Date]

Dear [Creditor’s Name],

I am writing to dispute the debt listed on my account, [Account Number]. I request that you provide me with the following information:

The original creditor

Please provide this information within [Number] days of receiving this letter.

I am aware of my rights under the Fair Debt Collection Practices Act (FDCPA). I expect a prompt and comprehensive response to my request.

Sincerely,

[Your Name]

Additional Tips for Creating a Professional Template

Use a Professional Font: Choose a font that is easy to read and conveys a professional image, such as Times New Roman or Arial.

By following these guidelines and incorporating the recommended design elements, you can create a professional and effective debt validation letter template that protects your rights and initiates the dispute resolution process.