A personal loan repayment agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a personal loan. It serves as a formal record of the agreement, protecting the interests of both parties involved.

Key Components of a Personal Loan Repayment Agreement

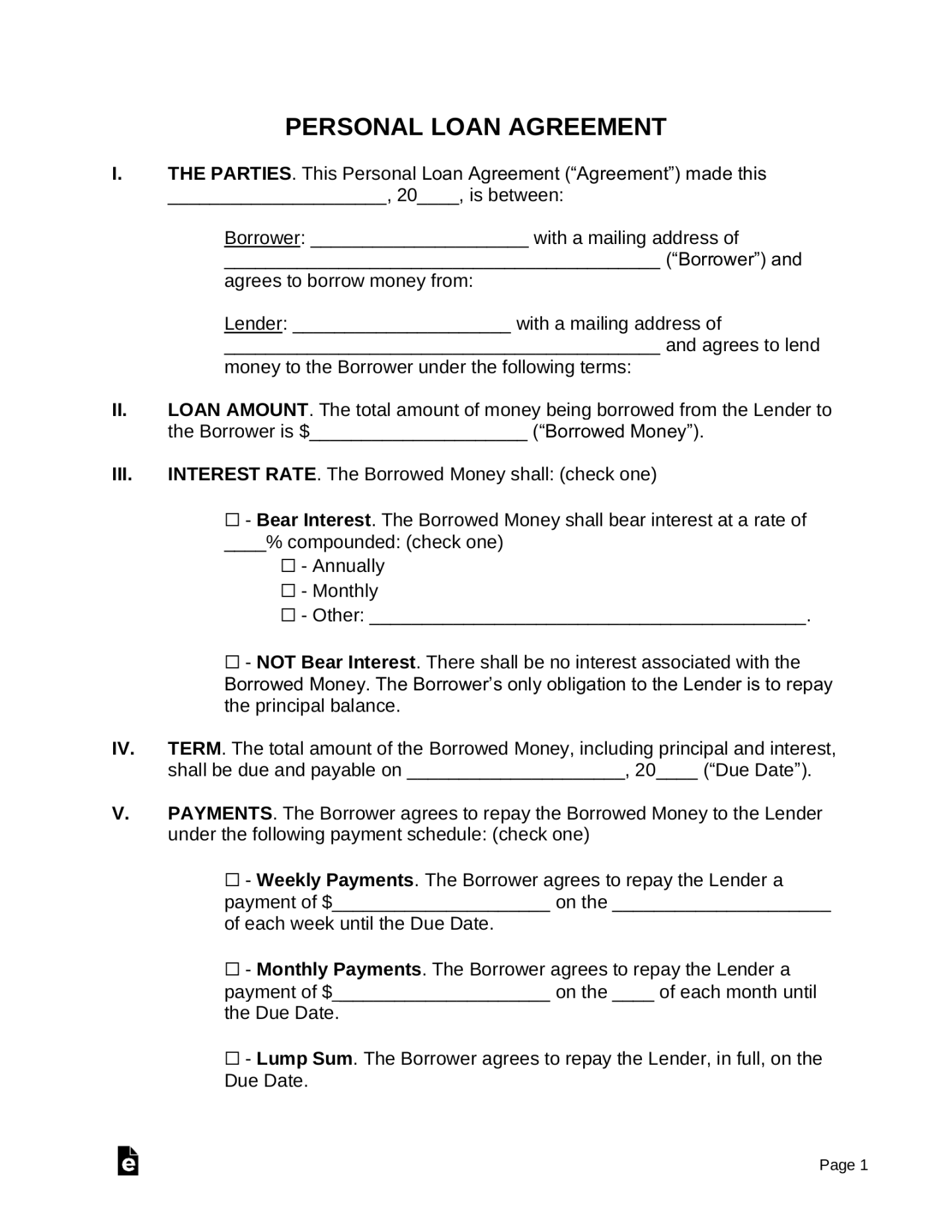

A comprehensive personal loan repayment agreement should include the following essential components:

1. Loan Amount and Interest Rate

Clearly state the total amount of the loan being provided.

2. Repayment Schedule

Detail the frequency of repayments (e.g., monthly, weekly).

3. Loan Term

Define the total duration of the loan agreement.

4. Prepayment Clause

Address the borrower’s right to prepay the loan before the maturity date.

5. Default and Remedies

Define what constitutes a default event (e.g., missed payments, breach of terms).

6. Governing Law and Jurisdiction

Specify the governing law that will apply to the agreement.

Design Elements for a Professional Personal Loan Repayment Agreement Template

To convey professionalism and trust, consider the following design elements when creating your personal loan repayment agreement template:

1. Clear and Concise Language

Use plain, straightforward language that is easy to understand.

2. Consistent Formatting

Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout

Use a clean and uncluttered layout that is visually appealing.

4. Branding Elements

If applicable, incorporate your branding elements into the template, such as your company logo and color scheme.

5. Legal Disclaimer

Include a legal disclaimer at the end of the document, stating that the agreement constitutes the entire agreement between the parties and supersedes any prior or contemporaneous communications.

Conclusion

A well-designed personal loan repayment agreement template is essential for establishing a clear and professional relationship between a lender and a borrower. By incorporating the key components and design elements discussed in this guide, you can create a document that is both informative and visually appealing, fostering trust and confidence in the loan transaction.