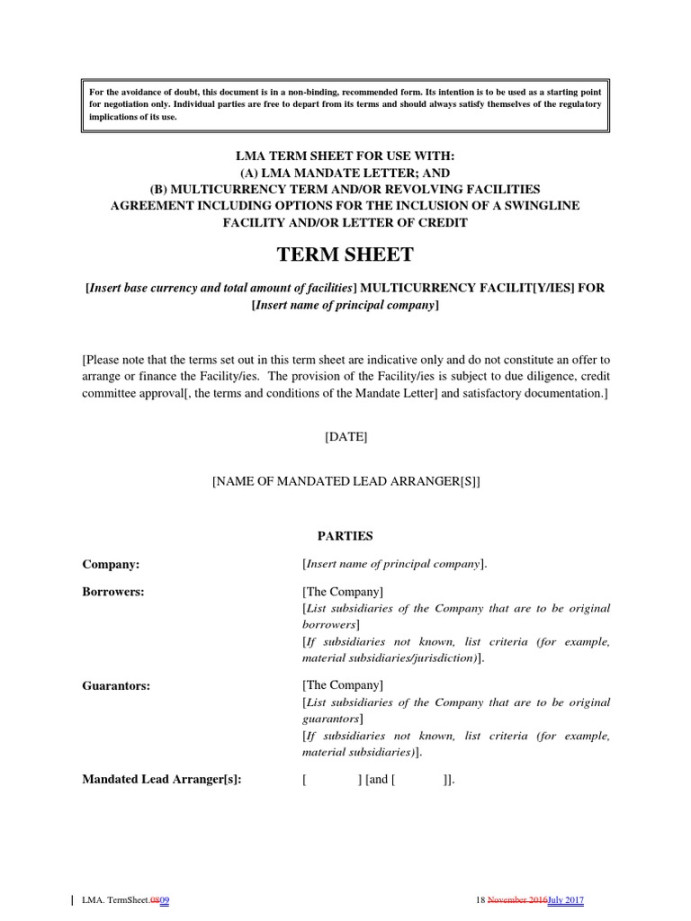

A Loan Market Association (LMA) loan agreement is a standardized legal document used in the financial industry to govern the terms and conditions of a loan transaction. These agreements are crucial for ensuring clarity, transparency, and legal compliance. Creating a professional LMA loan agreement template in WordPress format requires careful consideration of design elements, content organization, and legal accuracy.

Design Elements

1. Typography: Choose a clean, legible font that conveys professionalism and authority. Serif fonts like Times New Roman or Garamond are often preferred for legal documents. Ensure consistent font usage throughout the template.

2. Layout: Use a clear and organized layout that is easy to navigate. Consider using headings, subheadings, and bullet points to break up the text and improve readability. Maintain consistent margins, line spacing, and paragraph indentation.

3. Color Scheme: Opt for a color scheme that is professional and visually appealing. Avoid bright or flashy colors that can be distracting. Consider using a combination of black, white, and a neutral color like gray or blue.

4. Branding: If applicable, incorporate your company’s branding elements into the template. This can include your logo, color scheme, and font style. However, ensure that branding does not overshadow the legal content.

Content Organization

1. Recitals: This section provides background information about the loan transaction, including the parties involved, the loan amount, and the purpose of the loan.

2. Definitions: Clearly define any technical terms or acronyms used in the agreement. This helps to ensure that all parties have a common understanding of the language.

3. Covenants: This section outlines the obligations and restrictions imposed on the borrower. Covenants can include financial ratios, asset maintenance requirements, and restrictions on certain business activities.

4. Events of Default: Specify the events that could trigger a default under the loan agreement. Examples include failure to make payments, breach of covenants, or insolvency.

5. Remedies: Describe the remedies available to the lender in the event of a default. This may include acceleration of the loan, foreclosure, or legal action.

6. Governing Law and Jurisdiction: Indicate the governing law and jurisdiction that will apply to the loan agreement. This is important for resolving any disputes that may arise.

7. Notices: Specify the addresses and methods for delivering notices between the parties.

8. Entire Agreement: This clause states that the loan agreement constitutes the entire agreement between the parties and supersedes any prior or contemporaneous agreements.

9. Severability: This clause provides that if any provision of the loan agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

10. Counterparts: This clause allows for the execution of multiple counterparts of the loan agreement, each of which will be considered an original.

Legal Accuracy

1. Consult with Legal Counsel: Ensure that the LMA loan agreement template is prepared with the assistance of qualified legal counsel. Legal professionals can help to ensure that the agreement complies with applicable laws and regulations.

2. Use Standardized Language: Utilize standardized language and terminology from the LMA’s published loan agreement templates. This can help to avoid inconsistencies and potential legal issues.

3. Tailor to Specific Circumstances: While the LMA loan agreement template provides a solid foundation, it is essential to tailor the agreement to the specific circumstances of the loan transaction. This may involve adding or modifying certain provisions to address unique requirements.

By carefully considering these design elements, content organization, and legal accuracy, you can create a professional LMA loan agreement template in WordPress format that effectively governs the terms of a loan transaction.