A line of credit loan agreement template is a crucial document that outlines the terms and conditions of a line of credit loan between a lender and a borrower. It is essential to ensure that the template is professionally designed and comprehensive to establish trust and credibility. This guide will delve into the key elements that contribute to a professional line of credit loan agreement template.

Essential Elements of a Line of Credit Loan Agreement Template

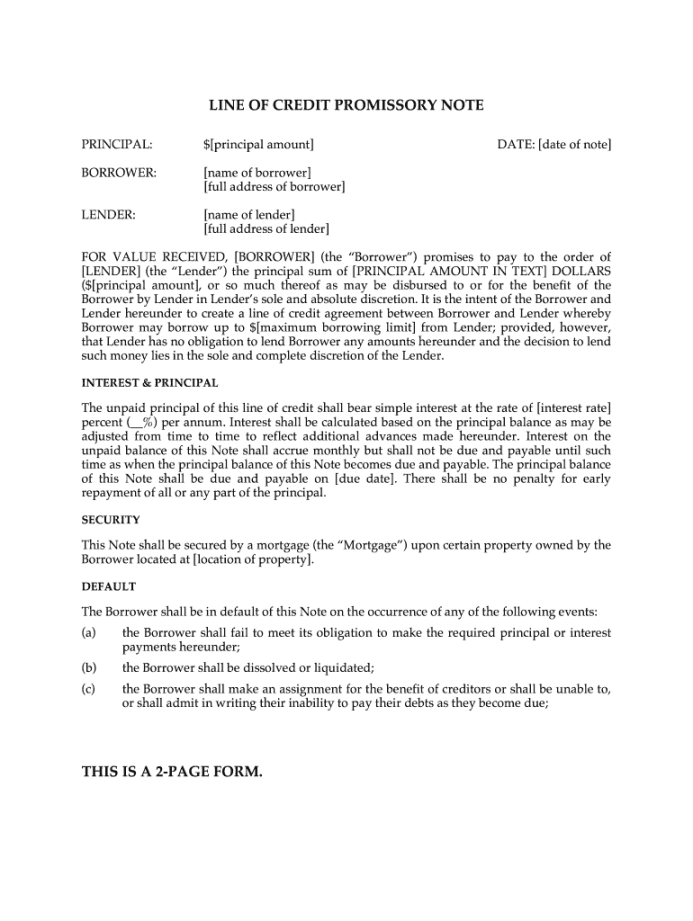

1. Loan Amount and Repayment Terms: Clearly specify the maximum loan amount available to the borrower and the repayment terms, including the interest rate, repayment schedule, and any applicable fees.

2. Interest Rate: Define the interest rate calculation method and whether it is fixed or variable. Consider including information about any applicable interest rate adjustments or penalties.

3. Repayment Schedule: Outline the frequency of repayments and the minimum payment amount required. Specify if there is a grace period for the first payment and any penalties for late payments.

4. Collateral: If applicable, describe the collateral that secures the loan. This may include real estate, equipment, or other assets.

5. Prepayment Clause: Specify whether the borrower can prepay the loan without penalty or if there is a prepayment fee.

6. Default and Remedies: Define what constitutes a default and the remedies available to the lender in case of a default. This may include acceleration of the loan balance, foreclosure, or legal action.

7. Governing Law and Jurisdiction: Specify the governing law and jurisdiction that will apply to the agreement.

8. Notices: Outline the address and method for sending notices between the lender and borrower.

9. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes all prior or contemporaneous communications.

10. Severability: Specify that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

11. Amendment: Outline the process for amending the agreement.

12. Waiver: Specify that any waiver of a breach of the agreement by one party does not constitute a waiver of any subsequent breach.

Design Elements for a Professional Template

1. Clear and Concise Language: Use plain and simple language that is easy to understand for both the lender and borrower. Avoid legal jargon or technical terms that may confuse the reader.

2. Consistent Formatting: Maintain consistent formatting throughout the template, including font size, font style, and spacing. This creates a professional and polished appearance.

3. Professional Layout: Use a clean and uncluttered layout that is easy to read and navigate. Avoid excessive use of graphics or images that may distract from the content.

4. Headings and Subheadings: Use headings and subheadings to organize the content and make it easier to find specific information.

5. White Space: Incorporate white space to improve readability and prevent the template from appearing crowded.

6. Branding: If applicable, include the lender’s branding elements, such as logo and colors, to create a cohesive and professional look.

Additional Considerations

1. Consultation with Legal Counsel: It is highly recommended to consult with legal counsel to ensure that the template complies with applicable laws and regulations.

2. Customization: Tailor the template to the specific needs of the lender and borrower. Consider including additional clauses or provisions as necessary.

3. Electronic Signatures: Explore the use of electronic signatures to streamline the signing process and reduce the need for physical copies.

4. Version Control: Maintain a version control system to track changes to the template and ensure that all parties are using the most up-to-date version.

By following these guidelines, you can create a professional line of credit loan agreement template that effectively outlines the terms and conditions of the loan and establishes trust between the lender and borrower.