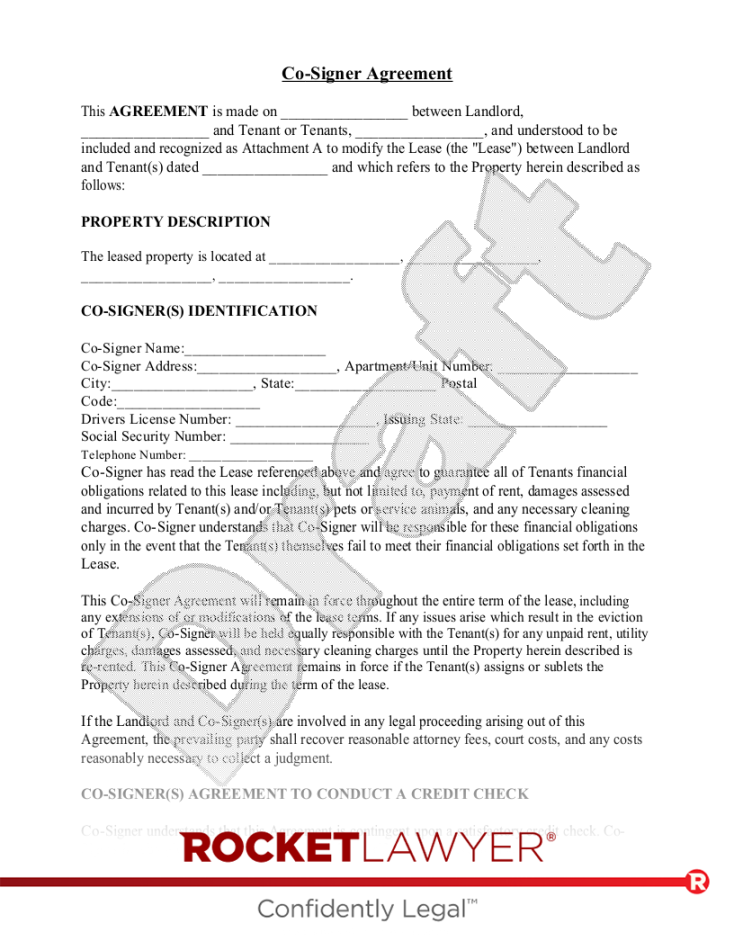

A cosigner loan agreement is a legal document that outlines the terms and conditions of a loan between a lender, borrower, and a cosigner. The cosigner agrees to be liable for the loan if the borrower defaults on their payments. This template serves as a foundation for creating a legally binding agreement that protects the interests of all parties involved.

Essential Elements of a Cosigner Loan Agreement Template

1. Identification of Parties: Clearly state the names and addresses of the lender, borrower, and cosigner.

2. Loan Amount and Terms: Specify the total loan amount, interest rate, repayment schedule, and any applicable fees or penalties.

3. Collateral (if applicable): If the loan is secured by collateral, describe the specific assets that will be used as security.

4. Cosigner’s Obligations: Clearly outline the cosigner’s responsibilities, including their commitment to repay the loan if the borrower defaults.

5. Default Provisions: Define what constitutes a default and the consequences of a default, such as acceleration of the loan balance, foreclosure on collateral, and potential legal action.

6. Governing Law and Jurisdiction: Specify the governing law and jurisdiction that will apply to the agreement in case of a dispute.

7. Entire Agreement: Indicate that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

8. Notices: Establish how and where notices will be sent between the parties.

9. Severability: Stipulate that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

10. Signatures: Ensure that all parties sign the agreement to make it legally binding.

Design Considerations for a Professional Cosigner Loan Agreement Template

1. Clarity and Conciseness: Use clear and concise language that is easy to understand for all parties involved. Avoid legal jargon that may confuse the reader.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and line spacing to create a clean and organized appearance.

4. White Space: Incorporate white space to improve visual appeal and make the document easier to navigate.

5. Branding (if applicable): If you are representing a specific organization, consider including branding elements such as a logo or letterhead to enhance professionalism.

6. Legal Disclaimer: While not strictly required, adding a disclaimer stating that the template is not legal advice and that it is recommended to consult with an attorney can protect you from liability.

Additional Tips for Creating a Professional Cosigner Loan Agreement Template

Use a Template Software: Consider using a template software or online platform to streamline the process of creating the agreement and ensure that it includes all necessary elements.

By following these guidelines and design considerations, you can create a professional cosigner loan agreement template that effectively protects the interests of all parties involved.