A Blank Loan Agreement Template is a fundamental document for any financial transaction involving a loan. It outlines the terms and conditions of the loan, ensuring that both the lender and borrower are protected. A well-designed template can enhance the professionalism of the transaction and foster trust between the parties.

Essential Elements of a Blank Loan Agreement Template

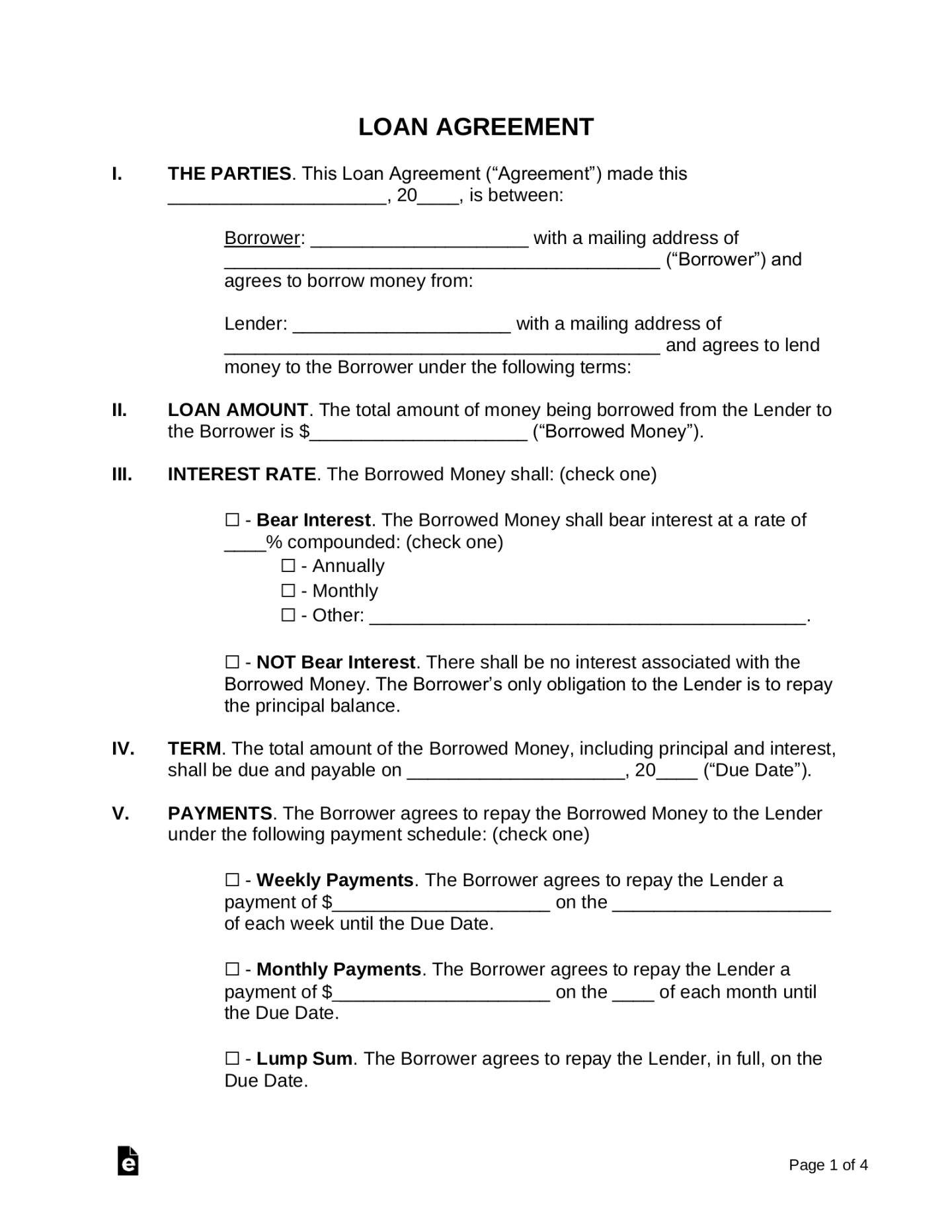

1. Loan Amount and Repayment Schedule: Clearly state the total loan amount, interest rate, and repayment schedule, including due dates and payment methods.

2. Borrower and Lender Information: Include the full names, addresses, and contact information of both the borrower and lender.

3. Loan Purpose: Specify the intended use of the loan funds. This information can help determine appropriate interest rates and repayment terms.

4. Collateral (if applicable): If the loan is secured by collateral, describe the specific assets that will be used as security.

5. Default Provisions: Outline the consequences of default, including late payment fees, acceleration of the loan balance, and potential legal action.

6. Governing Law: Specify the jurisdiction that will govern the loan agreement. This ensures that any disputes are resolved according to the applicable laws.

7. Entire Agreement: Include a clause stating that the loan agreement constitutes the entire understanding between the parties and supersedes any prior agreements or representations.

8. Signatures: Ensure that both the borrower and lender sign the agreement to indicate their acceptance of the terms and conditions.

Design Considerations for a Professional Blank Loan Agreement Template

1. Layout and Formatting: Use a clean and consistent layout with clear headings and subheadings. Employ professional fonts and spacing to enhance readability.

2. Professional Language: Use formal and precise language throughout the template. Avoid jargon or technical terms that may be unfamiliar to the parties.

3. Clarity and Conciseness: Express the terms and conditions in a clear and concise manner. Avoid unnecessary complexity or legal jargon that may confuse the parties.

4. Organization: Present the information in a logical and organized manner, following a clear structure that is easy to understand.

5. Consistency: Maintain consistency throughout the template in terms of formatting, language, and terminology.

6. White Space: Use white space effectively to create a visually appealing and easy-to-read document.

7. Branding (Optional): If applicable, incorporate your company’s branding elements, such as logo and colors, to enhance professionalism and recognition.

Example of a Blank Loan Agreement Template

LOAN AGREEMENT

This Loan Agreement is made and entered into as of [Date] by and between [Lender Name], a [Lender’s Business] with its principal place of business at [Lender’s Address] (the “Lender”), and [Borrower Name], an individual residing at [Borrower’s Address] (the “Borrower”).

1. Loan Amount: The Lender agrees to loan the Borrower the sum of [Loan Amount] (the “Loan”).

2. Interest Rate: The Borrower agrees to pay interest on the Loan at the rate of [Interest Rate]% per annum.

… [Remaining sections of the agreement, following the elements outlined above]

Conclusion

A well-designed Blank Loan Agreement Template is essential for any loan transaction. By incorporating the essential elements and adhering to professional design principles, you can create a document that is both informative and visually appealing. A professionally crafted template can help build trust between the lender and borrower, ensuring a smooth and successful financial transaction.