A business loan agreement template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This document is crucial for protecting the interests of both parties involved in the transaction. When creating a business loan agreement template, it is essential to adhere to specific design elements that convey professionalism and trust.

Key Components of a Business Loan Agreement Template

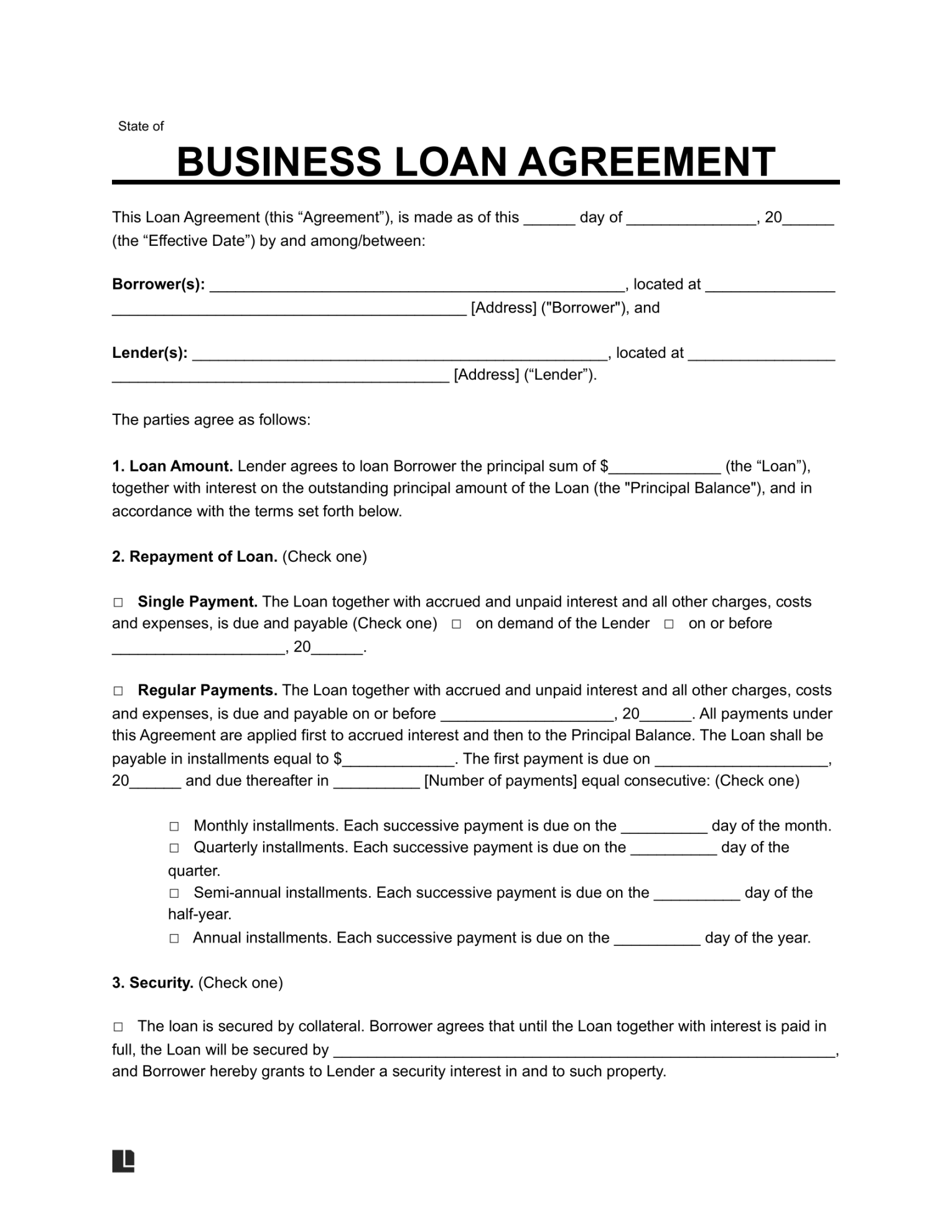

1. Parties Involved: Clearly identify the lender and the borrower. Include their full legal names and addresses.

2. Loan Amount: Specify the exact amount of the loan being provided.

3. Interest Rate: Indicate the interest rate that will be applied to the loan. This can be a fixed or variable rate.

4. Repayment Schedule: Outline the repayment terms, including the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

5. Collateral: If the loan is secured by collateral, describe the specific assets that will be used as collateral.

6. Default: Define what constitutes a default on the loan and outline the consequences of default.

7. Prepayment: Specify whether the borrower has the right to prepay the loan and if there are any prepayment penalties.

8. Governing Law: Indicate the jurisdiction that will govern the loan agreement.

9. Dispute Resolution: Specify the method for resolving disputes between the lender and the borrower (e.g., mediation, arbitration).

10. Signatures: Ensure that both the lender and the borrower sign the agreement.

Design Elements for a Professional Business Loan Agreement Template

1. Font Choice: Select a font that is easy to read and professional. Avoid using fonts that are overly decorative or difficult to decipher.

2. Layout and Formatting: Use a consistent layout and formatting throughout the document. This includes margins, spacing, and headings.

3. Heading Levels: Employ clear heading levels to organize the document and make it easy to navigate. Use headings such as “Loan Amount,” “Repayment Schedule,” and “Default.”

4. White Space: Use white space effectively to improve readability and create a visually appealing document. Avoid overcrowding the page with text.

5. Numbering and Bullet Points: Use numbering and bullet points to list items and make the document more organized.

6. Legal Terminology: Use precise legal terminology to ensure that the agreement is legally binding.

7. Clarity and Conciseness: Write the agreement in clear and concise language. Avoid using jargon or overly complex language.

8. Professional Appearance: Ensure that the overall appearance of the document is professional and polished. This includes the use of high-quality paper and printing.

Additional Considerations

Customization: Tailor the template to the specific needs of the loan transaction.

By following these guidelines, you can create a professional business loan agreement template that effectively protects the interests of both the lender and the borrower. A well-crafted template can help to prevent misunderstandings and disputes, ensuring a smooth and successful loan transaction.