A well-designed Credit Card Interest Calculator Excel Template can be a valuable tool for anyone looking to better understand their credit card debt and potential repayment strategies. By accurately calculating interest charges, users can make informed decisions about their finances and potentially reduce their overall debt burden.

Key Components of a Credit Card Interest Calculator Excel Template

A comprehensive Credit Card Interest Calculator Excel Template should include the following essential components:

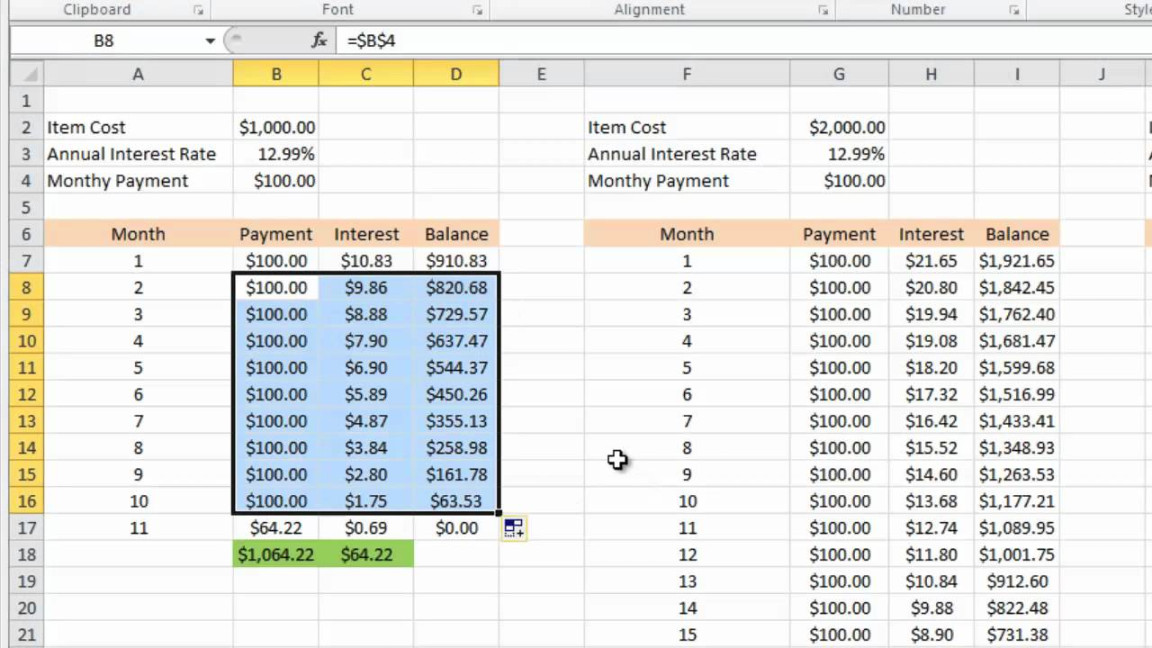

Input Fields: These fields allow users to enter relevant information, such as the initial credit card balance, annual interest rate, minimum monthly payment, and any additional fees or charges.

Design Elements for a Professional Excel Template

To create a professional and trustworthy Credit Card Interest Calculator Excel Template, consider the following design elements:

Clear and Consistent Formatting: Use consistent fonts, colors, and formatting throughout the template to enhance readability and professionalism.

Creating the Template

To create your Credit Card Interest Calculator Excel Template, follow these steps:

1. Open a New Workbook: Start by opening a new Excel workbook.

2. Design the Input Fields: Create input fields for the initial balance, annual interest rate, minimum monthly payment, and any additional fees.

3. Develop the Calculation Formulas: Use Excel’s built-in functions to calculate interest charges, monthly payments, and estimated repayment timeframes.

4. Create the Output Fields: Display the calculated results in clear and concise output fields.

5. Add Visualization Tools: If desired, include charts or graphs to visually represent the data.

6. Format the Template: Apply consistent formatting, logical layout, and descriptive labels to enhance the template’s appearance and usability.

7. Test the Template: Thoroughly test the template to ensure that the calculations are accurate and the user interface is intuitive.

By following these guidelines and incorporating the recommended design elements, you can create a professional and effective Credit Card Interest Calculator Excel Template that will help users make informed decisions about their finances.