Understanding the Credit Purchase Agreement Template

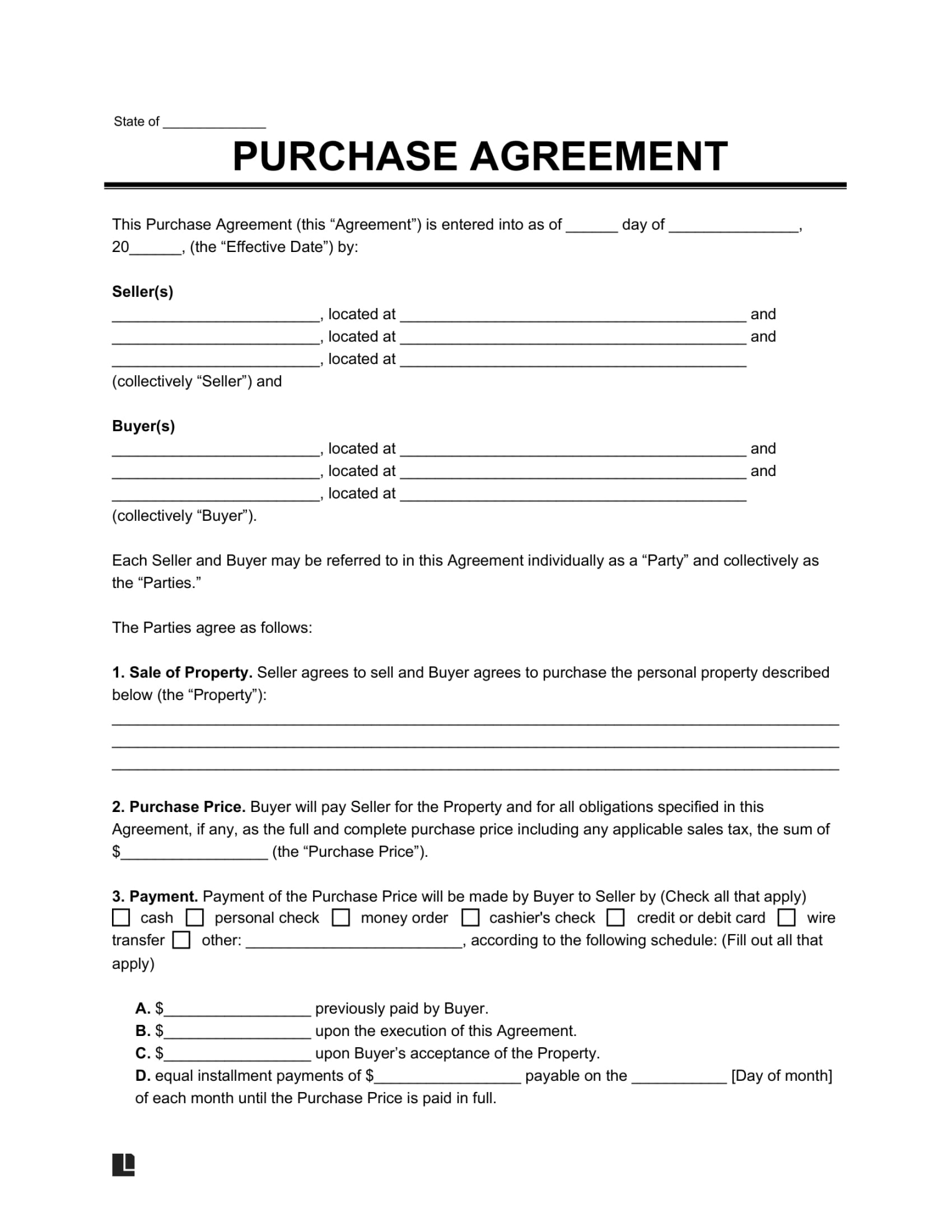

A credit purchase agreement template is a legal document that outlines the terms and conditions governing a credit transaction between a lender and a borrower. It serves as a contract that protects the interests of both parties involved. The template typically includes essential details such as the loan amount, interest rate, repayment schedule, collateral requirements, and default provisions.

Key Components of a Professional Credit Purchase Agreement Template

1. Parties Involved: Clearly identify the lender and borrower, including their legal names and addresses.

2. Loan Amount and Terms: Specify the total loan amount, interest rate, and repayment schedule.

3. Collateral: If applicable, describe the collateral that secures the loan, including its value and ownership.

4. Default Provisions: Outline the consequences of the borrower’s failure to meet their obligations, such as late fees, acceleration of the loan balance, or foreclosure.

5. Governing Law: Indicate the jurisdiction that will govern the agreement in case of disputes.

6. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

7. Assignment and Novation: Address the rights of the lender to assign the agreement to a third party and the possibility of novation, where a new party replaces the original borrower.

8. Notices: Specify how notices and communications should be sent between the parties.

9. Severability: Ensure that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

10. Waiver: Clarify that a waiver of any breach of the agreement does not constitute a waiver of any subsequent breach.

11. Force Majeure: Address circumstances beyond the control of either party that may excuse performance of the agreement, such as natural disasters or acts of war.

12. Dispute Resolution: Specify the method for resolving disputes, such as mediation, arbitration, or litigation.

Design Elements for Professionalism and Trust

1. Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon that may confuse the borrower.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, bullet points, and numbering to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and line spacing to create a clean and organized appearance.

4. Branding Elements: If applicable, incorporate your company’s branding elements, such as your logo and color scheme, to establish trust and credibility.

5. White Space: Use white space effectively to create a visually appealing document and improve readability.

6. Table of Contents: For longer agreements, include a table of contents to help readers navigate the document.

7. Signatures: Ensure that the agreement is signed by both parties to make it legally binding.

Additional Considerations

Customization: Tailor the template to meet the specific needs of your business and the type of credit transaction you are offering.

By following these guidelines and incorporating the key components of a credit purchase agreement template, you can create a professional and legally sound document that protects your business and establishes trust with your borrowers.