Islamic loan agreements are legal contracts that outline the terms and conditions of a financial transaction between two parties, adhering to Islamic principles. These principles, such as the prohibition of interest (riba), require a unique approach to loan agreements compared to conventional ones.

To create a professional Islamic loan agreement template using WordPress, consider the following design elements and content structure:

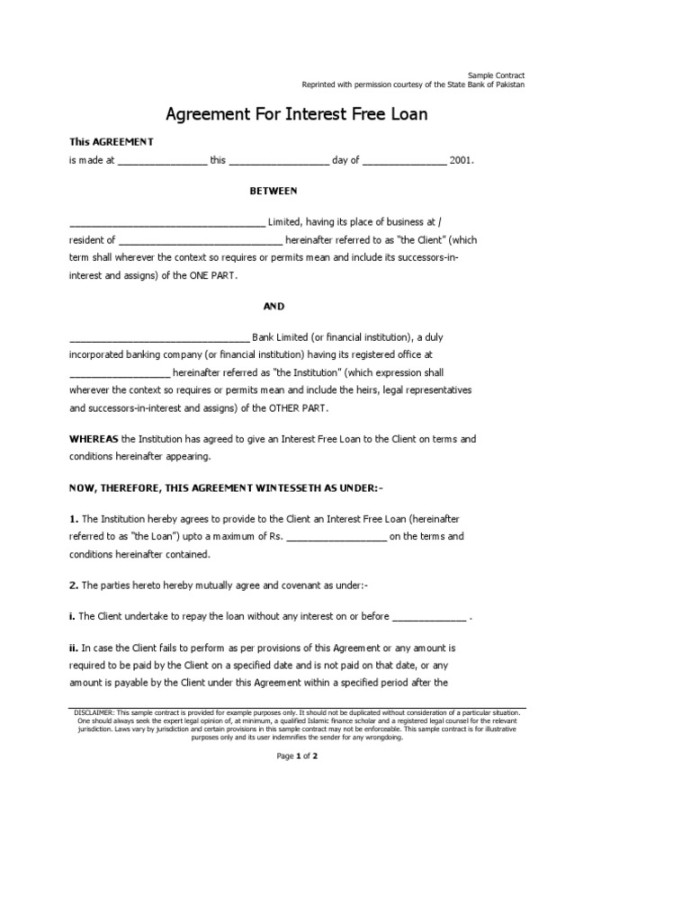

1. Header

Logo: Place your organization’s logo prominently in the top left corner to establish credibility and brand recognition.

2. Parties Involved

Lender: Specify the name, address, and contact information of the lender (the party providing the loan).

3. Recitals

Purpose: Clearly state the purpose of the loan, such as financing a business, education, or personal expenses.

4. Loan Amount and Repayment Schedule

Principal: Specify the total amount of the loan.

5. Profit Sharing (Musharakah)

Profit-Sharing Ratio: Determine the ratio in which the lender and borrower will share the profits generated by the loan.

6. Collateral (If Applicable)

Description: If collateral is required, provide a detailed description of the assets being pledged.

7. Default and Remedies

Default: Define what constitutes a default, such as missed payments or breach of contract.

8. Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction that will govern the agreement.

9. Entire Agreement

10. Signatures

Signatures: Provide space for both the lender and borrower to sign the agreement.

11. Additional Clauses (Optional)

Prepayment: Address the possibility of early repayment and any associated penalties or fees.

12. Footer

Contact Information: Include your organization’s contact information, such as address, phone number, and website.

Design Considerations:

Clarity and Conciseness: Use clear and concise language to avoid confusion.

By following these guidelines and considering the design elements, you can create a professional and effective Islamic loan agreement template that meets the specific requirements of Islamic finance and provides a clear and legally sound framework for your loan transactions.