A minority shareholder agreement is a legal document that outlines the rights, obligations, and protections of a shareholder who owns less than 50% of a company’s shares. It is essential for minority shareholders to have a well-crafted agreement in place to safeguard their interests and ensure fair treatment within the company.

Key Components of a Minority Shareholder Agreement

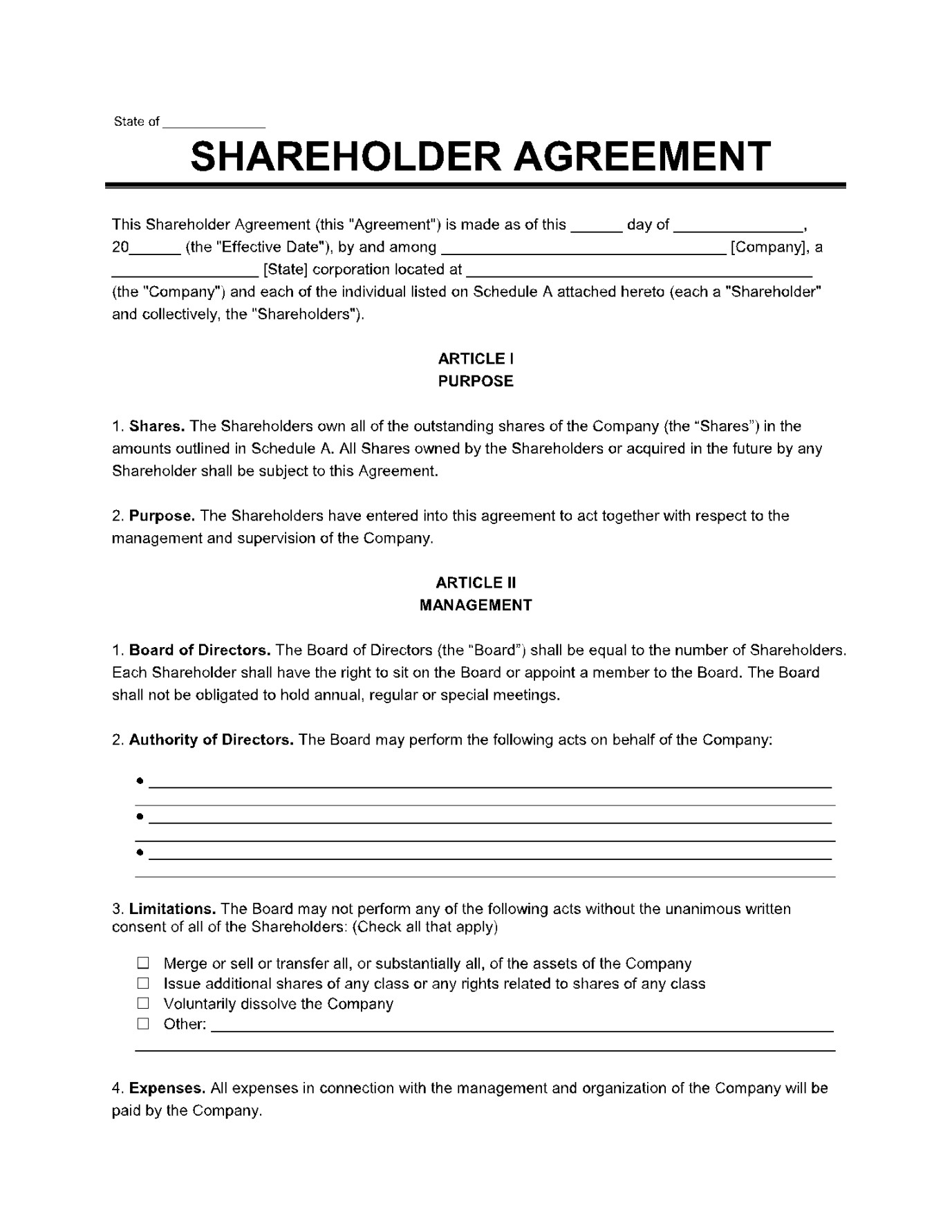

1. Identification of Parties: Clearly state the names and addresses of all parties involved in the agreement.

2. Definition of Terms: Define any technical or industry-specific terms that may be used in the agreement.

3. Shareholding Structure: Specify the percentage of shares owned by each party and the distribution of voting rights.

4. Voting Rights: Outline the voting procedures and how minority shareholders can exercise their voting rights.

5. Preemptive Rights: Establish the right of minority shareholders to purchase additional shares in the company before they are offered to outsiders.

6. Drag-Along Rights: Grant the majority shareholder the right to force minority shareholders to sell their shares if the majority shareholder receives a takeover offer.

7. Tag-Along Rights: Give minority shareholders the right to require the majority shareholder to sell their shares if the majority shareholder receives a takeover offer.

8. Anti-Dilution Protection: Safeguard the value of minority shareholders’ shares in case of future equity issuances.

9. Information Rights: Ensure minority shareholders have access to relevant financial and operational information.

10. Dispute Resolution: Specify the mechanism for resolving disputes between the parties, such as arbitration or mediation.

11. Non-Compete and Non-Solicitation Clauses: Restrict the ability of minority shareholders to compete with or solicit clients from the company.

12. Confidentiality Provisions: Protect the company’s confidential information.

13. Transfer Restrictions: Limit the ability of minority shareholders to transfer their shares without the consent of the company or majority shareholder.

14. Termination Provisions: Outline the circumstances under which the agreement can be terminated.

Design Elements for a Professional and Trustworthy Template

1. Clear and Concise Language: Use plain English and avoid legal jargon that may be difficult for non-lawyers to understand.

2. Consistent Formatting: Maintain consistent formatting throughout the document, including font size, line spacing, and headings.

3. Professional Layout: Use a clean and professional layout that is easy to read and navigate.

4. Headings and Subheadings: Use clear and informative headings and subheadings to organize the content.

5. Numbered or Bulleted Lists: Use numbered or bulleted lists to present information in a concise and organized manner.

6. Tables and Charts: Use tables and charts to present complex data in a visually appealing and understandable format.

7. White Space: Use white space effectively to create a visually appealing document and improve readability.

8. Branding Elements: Incorporate your company’s branding elements, such as your logo and color scheme, to create a cohesive and professional look.

Conclusion

A well-crafted minority shareholder agreement is a vital tool for protecting the interests of minority shareholders and ensuring the smooth operation of a company. By carefully considering the key components and design elements outlined in this guide, you can create a professional and trustworthy template that will serve as a valuable asset to your business.