A payroll confidentiality agreement is a legally binding document that outlines the specific obligations of an individual or entity to maintain the confidentiality of sensitive payroll information. This agreement is crucial for businesses to protect their employees’ personal and financial data, as well as to maintain a positive reputation and avoid legal issues.

Essential Components of a Payroll Confidentiality Agreement

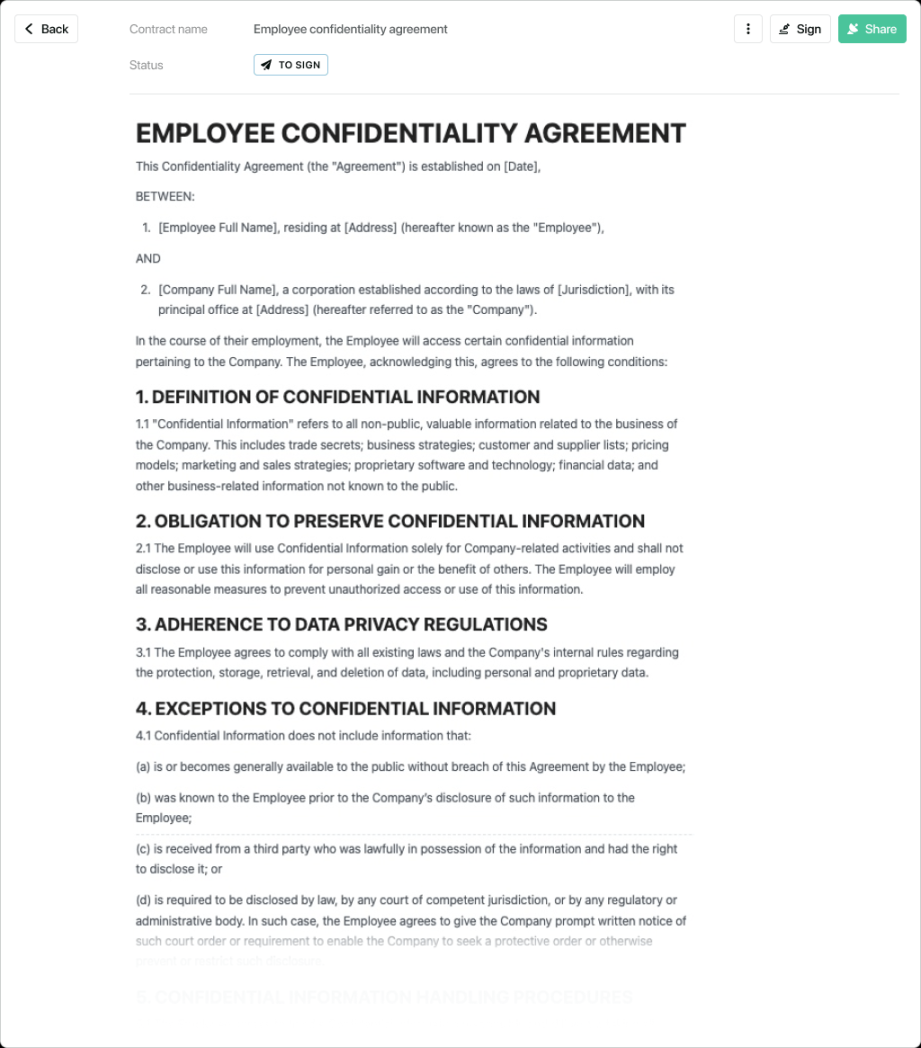

A well-crafted payroll confidentiality agreement should include the following essential components:

Parties Involved

Clearly identify the parties involved in the agreement. This typically includes the employer and the employee or contractor.

Scope of Confidentiality

Define the specific types of payroll information that are considered confidential. This may include, but is not limited to, employee names, addresses, Social Security numbers, salaries, wages, bonuses, deductions, and benefits.

Obligations of Confidentiality

Outline the specific obligations of the employee or contractor to maintain the confidentiality of payroll information. This should include a prohibition against disclosing or using the information for any unauthorized purpose.

Exceptions to Confidentiality

Specify any exceptions to the confidentiality obligation. This may include situations where disclosure is required by law or with the written consent of the employer.

Term and Termination

Indicate the duration of the agreement and the circumstances under which it may be terminated. Consider including a provision that requires the employee or contractor to return all confidential information upon termination of the agreement.

Governing Law and Dispute Resolution

Specify the governing law that will apply to the agreement and the dispute resolution mechanism. This may include a provision for arbitration or mediation.

Entire Agreement

Include a clause stating that the agreement constitutes the entire agreement between the parties and supersedes any prior or contemporaneous communications or agreements.

Severability

Include a severability clause that provides that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

Confidentiality and Non-Disclosure

Reinforce the confidentiality obligations of the employee or contractor. Use clear and concise language to emphasize the importance of protecting sensitive payroll information.

Data Security

Address the employer’s commitment to implementing appropriate security measures to protect payroll data. This may include measures such as encryption, access controls, and regular backups.

Design Elements for a Professional Payroll Confidentiality Agreement

A professional payroll confidentiality agreement should be visually appealing and easy to read. Consider incorporating the following design elements:

Clear and Concise Language: Use simple and straightforward language that is easy to understand. Avoid legal jargon that may confuse the employee or contractor.

Additional Considerations

When creating a payroll confidentiality agreement, it is important to consider the following factors:

Jurisdiction: Ensure that the agreement complies with the applicable laws and regulations in your jurisdiction.

By following these guidelines and incorporating the essential components and design elements, you can create a professional payroll confidentiality agreement that effectively protects your employees’ personal and financial information and safeguards your business’s reputation.