Essential Sections and Their Content

A well-structured trade finance loan agreement template is crucial for ensuring a clear and legally binding contract between the lender and borrower. The following sections are essential components of such a template:

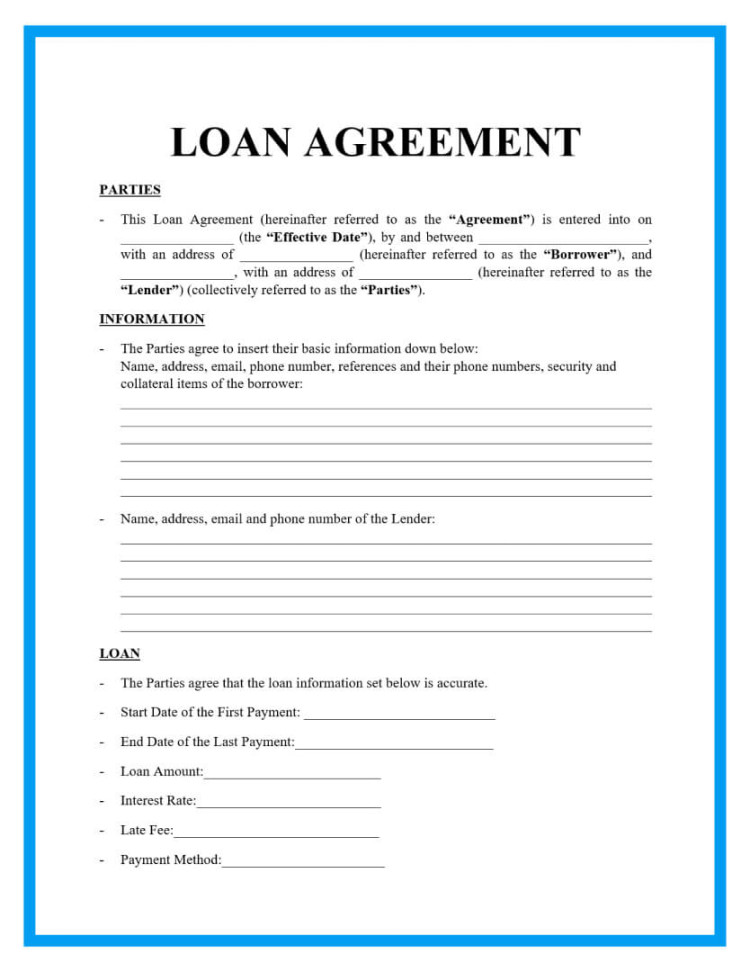

1. Parties to the Agreement

Identify the parties: Clearly state the names and legal entities of both the lender and the borrower.

2. Loan Amount and Terms

Loan amount: Clearly state the total amount of the loan being granted.

3. Collateral

Describe the collateral: Clearly identify the type of collateral being provided to secure the loan.

4. Covenants

Affirmative covenants: Outline the actions that the borrower must take to maintain the loan in good standing, such as providing financial statements or maintaining a minimum working capital.

5. Events of Default

Define default: Clearly outline the events that could trigger a default, such as failure to make payments, breach of covenants, or insolvency.

6. Governing Law and Jurisdiction

Choose applicable law: Specify the governing law that will apply to the agreement.

7. Dispute Resolution

Outline dispute resolution mechanisms: Specify the methods for resolving disputes, such as mediation or arbitration.

Design Elements for Professionalism and Trust

A professional and well-designed trade finance loan agreement template can enhance the credibility and trustworthiness of the document. Consider the following design elements:

Clear and concise language: Use simple and straightforward language that is easy to understand.

Additional Considerations

Legal review: Ensure that the template is reviewed by a legal professional to ensure compliance with applicable laws and regulations.

By carefully considering these essential sections, design elements, and additional considerations, you can create a professional and effective trade finance loan agreement template that protects the interests of both the lender and the borrower.